In December, Alaska Airlines announced plans to merge with Hawaiian Airlines. If this merger were approved, the airlines of the 49th and 50th U.S. states would join forces, albeit remaining separate entities. Despite this, a Hawaiian Airlines stakeholder filed a lawsuit against the merger to prevent it from proceeding.

Anti-Antitrust

In recent history, airline partnerships or mergers in the United States have been met with staunch opposition from the government. The Biden administration has been keen on encouraging more competition among U.S. carriers, meaning new mergers or partnerships would face major regulatory hurdles.

Plenty of recent examples show the government's anti-merger sentiment at play. The Department of Justice struck down JetBlue's proposed merger and takeover of Spirit Airlines on January 16. It was claimed that this merger violated antitrust law and would be contrary to the government's interests. An argument was made that this merger would jack up airfares, going against the purpose of ultra-low-cost carriers such as Spirit Airlines. JetBlue denied this claim, saying that its merger with Spirit would work to create a proper competitor to the "Big Four" U.S. airlines and further contribute to lowering airfares.

JetBlue's "Northeast Alliance" with American Airlines was also rejected based on similar reasoning. In short, such airline mergers and partnerships are "anti-antitrust." While the government has not officially made a statement on the Alaska-Hawaiian Airlines merger, a similar response to the JetBlue-Spirit merger can be expected based on reasoning related to violations of antitrust law.

Alaska-Hawaiian Merger Update

A Hawaiian Airlines shareholder filed a lawsuit against Alaska Airlines' $1.9 billion purchase of the carrier. This lawsuit claims the merger violates various acts and regulations, particularly the Securities and Exchange Act of 1934. This act requires the disclosure of important information by anyone seeking to acquire more than 5% of a company's securities by direct purchase or tender offer. At the moment, it is unclear what information Alaska failed to disclose regarding its purchase of Hawaiian Airlines.

The two airlines have sought approval from the Department of Justice amid concerns of antitrust setbacks; an issue discussed earlier related to the JetBlue-Spirit merger. The merger is still scheduled to occur and is expected to take up to 18 months. Despite Hawaiian being open to purchases from other airlines, the airline has stated that it remains firm on its agreement with Alaska.

If the merger continues, the two airlines will retain their separate branding. However, the Alaska takeover highlights a rather positive outlook for Hawaiian, an airline struggling with a growing debt of around $900 million.

Alaska Airlines CEO Ben Minicucci said the following about keeping the brands separate:

"We have a longstanding and deep respect for Hawaiian Airlines, for their role as a top employer in Hawai'i, and for how their brand and people carry the warm culture of aloha around the globe."

The future of both airlines appears to be well-planned. However, what will come of the lawsuit against the merger, the first major legal challenge to this nearly $2 billion deal, remains to be seen.

Comments (0)

Add Your Comment

SHARE

TAGS

NEWS Alaska Airlines Hawaiian Airlines Alaska Hawaii Government Politics Antitrust Mergers and Acquisitions LawsuitRECENTLY PUBLISHED

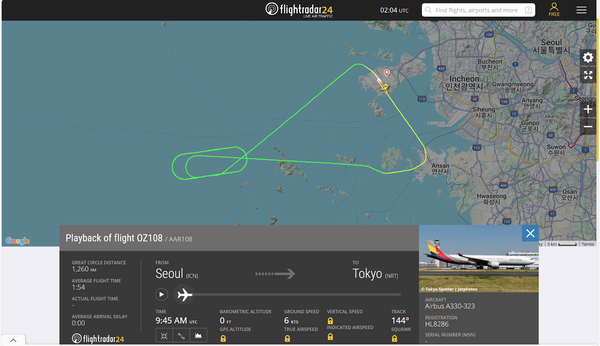

Tokyo-Bound Asiana Flight Experiences Engine Failure

An Asiana Airlines flight bound for Tokyo experienced an engine failure, prompting its return to Incheon International Airport.

NEWS

READ MORE »

Tokyo-Bound Asiana Flight Experiences Engine Failure

An Asiana Airlines flight bound for Tokyo experienced an engine failure, prompting its return to Incheon International Airport.

NEWS

READ MORE »

Learjet Owned By Vince Neil Crashes Into Gulfstream Jet, 1 Fatality Confirmed

On February 10th, around 14:30 local time, a Learjet private jet aircraft crashed into another private jet after landing at Scottsdale Airport (SCF) in Arizona.

NEWS

READ MORE »

Learjet Owned By Vince Neil Crashes Into Gulfstream Jet, 1 Fatality Confirmed

On February 10th, around 14:30 local time, a Learjet private jet aircraft crashed into another private jet after landing at Scottsdale Airport (SCF) in Arizona.

NEWS

READ MORE »

Seattle Plane Strike 2025: Japan Airlines and Delta Collision Raises Safety Concerns

Seattle-Tacoma International Airport saw a concerning incident on Wednesday morning when a Japan Airlines (JAL) plane clipped a parked Delta Air Lines jet while taxiing. Thankfully, no one was injured, but passengers described the collision as a frightening experience.

NEWS

READ MORE »

Seattle Plane Strike 2025: Japan Airlines and Delta Collision Raises Safety Concerns

Seattle-Tacoma International Airport saw a concerning incident on Wednesday morning when a Japan Airlines (JAL) plane clipped a parked Delta Air Lines jet while taxiing. Thankfully, no one was injured, but passengers described the collision as a frightening experience.

NEWS

READ MORE »