Lufthansa (LH) has entered into an agreement with private equity group AURELIUS to sell the remaining business of LSG Group. In 2019, European LSG Sky Chefs activities were already sold to Gategroup. This move is part of Lufthansa Group's strategy to focus more on its airline business in the future, which is expected to have a positive impact on the Group's operating margin and capital return.

This transaction encompasses all the traditional catering, onboard retail, and food commerce activities and trademarks of the LSG Group, as well as 131 LSG Sky Chefs Customer Service Centers (CSCs) in the Americas, EMMA, and Asia-Pacific (APAC) regions, Retail InMotion (RiM), and SCIS Air Security Services.

The transaction brings together approximately 19,000 employees and 36 joint ventures worldwide.

Executive Insights

Deutsche Lufthansa AG has expressed satisfaction in finding the appropriate investor, AURELIUS, for the sale of the remaining LSG Group business.

The Lufthansa Group is focusing on its airline business in the future, hence the sale of the catering segment. The deal is anticipated to have a positive impact on Lufthansa Group’s operating margin (Adjusted EBIT) and capital return (Adjusted ROCE).

"This is the beginning of a new chapter for the LSG Group," said LSG Group CEO Erdmann Rauer. "With AURELIUS, we have found a trustworthy partner who buys into our global strategy, which focuses on the three pillars of airline catering, onboard retail and food commerce. We are excited about what the future holds for our company – especially for our employees – and the many business opportunities we plan to seize. With the support of AURELIUS, we are confident that we will drive decisive change within our industry."

Dr. Dirk Markus, Founding Partner of AURELIUS, has shown confidence in the LSG Group management team, stating that Aurelius will work with them to become an even more successful stand-alone company. Following the closure of the deal, the LSG Group will be able to focus on implementing its ambitious three-pillar strategy to take advantage of growth opportunities and become an innovative market leader, with the assistance of its new owner.

The completion of the transaction is anticipated to occur in the third quarter of 2023, subject to necessary external authorizations and internal carve-out procedures.

Comments (0)

Add Your Comment

SHARE

TAGS

NEWS Lufthansa LSG Group AURELIUS Group Aviation News SaleRECENTLY PUBLISHED

PHOTOS: Award-Winning Pakistani C-130 Wows Spectators at RIAT 2025 Airshow

The Royal International Air Tattoo (RIAT), recognized as the world’s largest military air show, was held this July 2025 in the United Kingdom. Pakistan, once again eyeing the skies, was awarded the “Concours d’Elegance Trophy” at the event for its exhibition.

NEWS

READ MORE »

PHOTOS: Award-Winning Pakistani C-130 Wows Spectators at RIAT 2025 Airshow

The Royal International Air Tattoo (RIAT), recognized as the world’s largest military air show, was held this July 2025 in the United Kingdom. Pakistan, once again eyeing the skies, was awarded the “Concours d’Elegance Trophy” at the event for its exhibition.

NEWS

READ MORE »

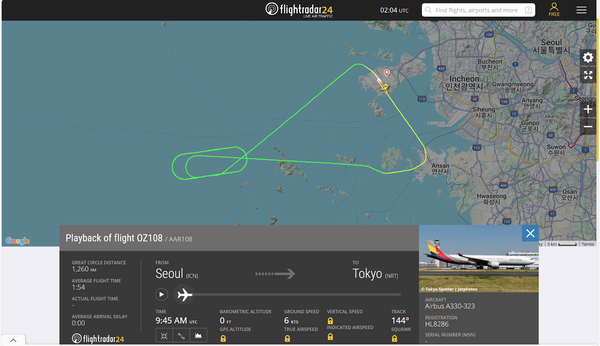

Tokyo-Bound Asiana Flight Experiences Engine Failure

An Asiana Airlines flight bound for Tokyo experienced an engine failure, prompting its return to Incheon International Airport.

NEWS

READ MORE »

Tokyo-Bound Asiana Flight Experiences Engine Failure

An Asiana Airlines flight bound for Tokyo experienced an engine failure, prompting its return to Incheon International Airport.

NEWS

READ MORE »

Learjet Owned By Vince Neil Crashes Into Gulfstream Jet, 1 Fatality Confirmed

On February 10th, around 14:30 local time, a Learjet private jet aircraft crashed into another private jet after landing at Scottsdale Airport (SCF) in Arizona.

NEWS

READ MORE »

Learjet Owned By Vince Neil Crashes Into Gulfstream Jet, 1 Fatality Confirmed

On February 10th, around 14:30 local time, a Learjet private jet aircraft crashed into another private jet after landing at Scottsdale Airport (SCF) in Arizona.

NEWS

READ MORE »