Spirit Airlines, America's largest ultra-low-cost airline, is struggling with various aspects of its operation. The carrier is expecting less revenue in the second quarter of 2024, an issue that stems from a multitude of issues.

A320neo Groundings

Spirit Airlines has been forced to ground a significant number of its Airbus A320neo family of aircraft amid recent engine issues.

The Spirit Airlines A320neo fleet is powered by Pratt and Whitney PW1100G engines. Over the past year, the company has been in the news regarding certain issues related to the engines it produces for the A320neo family of aircraft.

Specifically, Pratt and Whitney found issues with the powdered metal used to manufacture high-pressure turbines and compressor discs in their engines. These issues warranted the need to inspect Spirit's A320neo fleet. Spirit Airlines has said that Pratt and Whitney would replace the defective powdered metal parts.

Furthermore, the airline could receive anywhere from $150-200 million in compensation for the struggles it faced from grounding various planes. This compensation would come from International Aero Engines (IAE), an affiliate of Pratt and Whitney, in the form of a monthly credit throughout 2024.

Currently, Spirit is expected to ground 40 A320NEO aircraft this year as inspections continue for engine issues. The situation is projected to worsen by 2025 as the carrier estimates that it will have 70 planes out of service.

The widespread grounding of the Spirit Airlines fleet comes at a poor time. The aviation industry, particularly in North America, continues to experience increased demand. Spirit having insufficient amounts of aircraft to meet demand plays a key role in the carrier being unable to meet its financial goals for 2024.

Spirit Airlines - Financial State

With the widespread grounding of its A320neo fleet, Spirit finds itself having a surplus of employees, but not enough planes to go around, thereby increasing operating costs.

To compensate, the carrier has announced plans to furlough up to 260 pilots in September. It will roll out more measures to cut costs by $100 million this year. The carrier will also postpone future aircraft deliveries from the second quarter of 2025 through 2026 from a recent deal brokered with Airbus.

{AD>

As per the airline's Q1 2024 results, Spirit expects to make less revenue in the second quarter of the year compared to the same period last year. The airline reported operating revenues of $1.2 billion in Q1 2024, 6.2% compared to the same time frame in 2023. Simultaneously, Spirit's operating costs ticked up resulting in an operating loss of $207.3 million. The airline's net loss was $142.6 million.

The airline is suffering from excess capacity (not being able to fill seats) in key markets. This is causing Spirit to heavily discount their airfares just to fill planes, meaning the average fare per passenger was down 16% in Q1 2024 compared to Q1 2023.

To better align its capacity with supply and demand, Spirit has exited a few cities and airports that do not entirely support its current strategy.

However, despite the airline struggling to avoid losses, it is making progress toward its financial goals according to CEO Ted Christie.

Compensation for its grounded planes, deferred plane deliveries, and cost savings will improve the airline's cash levels in 2025, bringing savings up to $550 million.

Comments (0)

Add Your Comment

SHARE

TAGS

NEWS Spirit AirlinesPratt and WhitneyEngine IssuesSpirit Airlines engine issuesAirbus A320neoAirbusSpirit A320neoRECENTLY PUBLISHED

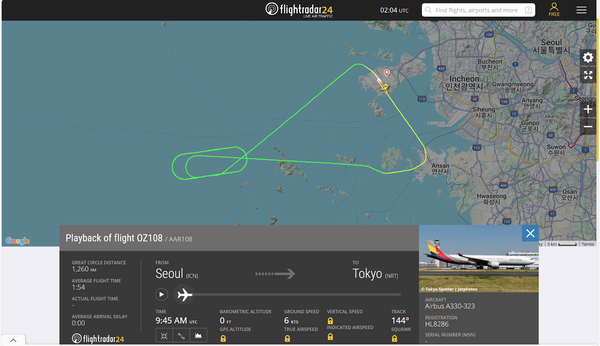

Tokyo-Bound Asiana Flight Experiences Engine Failure

An Asiana Airlines flight bound for Tokyo experienced an engine failure, prompting its return to Incheon International Airport.

NEWS

READ MORE »

Tokyo-Bound Asiana Flight Experiences Engine Failure

An Asiana Airlines flight bound for Tokyo experienced an engine failure, prompting its return to Incheon International Airport.

NEWS

READ MORE »

Learjet Owned By Vince Neil Crashes Into Gulfstream Jet, 1 Fatality Confirmed

On February 10th, around 14:30 local time, a Learjet private jet aircraft crashed into another private jet after landing at Scottsdale Airport (SCF) in Arizona.

NEWS

READ MORE »

Learjet Owned By Vince Neil Crashes Into Gulfstream Jet, 1 Fatality Confirmed

On February 10th, around 14:30 local time, a Learjet private jet aircraft crashed into another private jet after landing at Scottsdale Airport (SCF) in Arizona.

NEWS

READ MORE »

Seattle Plane Strike 2025: Japan Airlines and Delta Collision Raises Safety Concerns

Seattle-Tacoma International Airport saw a concerning incident on Wednesday morning when a Japan Airlines (JAL) plane clipped a parked Delta Air Lines jet while taxiing. Thankfully, no one was injured, but passengers described the collision as a frightening experience.

NEWS

READ MORE »

Seattle Plane Strike 2025: Japan Airlines and Delta Collision Raises Safety Concerns

Seattle-Tacoma International Airport saw a concerning incident on Wednesday morning when a Japan Airlines (JAL) plane clipped a parked Delta Air Lines jet while taxiing. Thankfully, no one was injured, but passengers described the collision as a frightening experience.

NEWS

READ MORE »