Embraer's E-Jet family is one of the most successful families of regional or narrowbody aircraft ever produced, with over 1,600 examples built as of March 31st, 2023.

Nowhere else can the popularity of this aircraft family be more profound than in the United States, with nearly 700 E-Jets currently operating for American-based airlines.

Given the sheer popularity of this aircraft family in the States, it would be reasonable to assume that Embraer's latest additions to its E-Jet lineup, the E2 family, would be just as if not even more popular.

Believe it or not, this is not the case.

Not a single U.S. carrier has placed an order for any of Embraer's new E2 jets, be they the E175-E2, E190-E2, or E195-E2. The reason for this is not because the airlines don't want the planes, it's because they are simply not allowed to fly them.

Scope Clauses Explained

A "scope clause" is an agreement that limits the number of passengers a regional aircraft can carry and the maximum takeoff weight (MTOW) of that aircraft.

In the United States, the maximum number of passengers is limited to 76, and the maximum takeoff weight is restricted to 86,000 pounds. A small number of aircraft are exempted from the seating limit and currently operate with 79 seats.

Scope clauses and their stipulations can vary based on the airline because it's actually not the airlines that create them. In fact, scope clauses are negotiated and implemented by pilot unions and each airline's pilot union has its own way of enforcing the limitations.

But why do scope clauses exist? To protect the jobs of pilots in the aforementioned unions.

By placing limits on certain aspects of regional airline and aircraft operations, scope clauses protect jobs from being outsourced. If a certain airline wanted to expand its regional operation, it would have to either expand its mainline operation first or come to a new agreement with its pilot union.

As per the scope clause, airlines place a cap on how many regional aircraft they can fly. In the case of American Airlines, the amount of 65 to 76-seater aircraft it operates must never exceed 40% of its mainline narrowbody fleet.

To better illustrate how a scope clause can work, let's use American Airlines as an example.

Let's say that, just for the example's sake, American has 800 mainline narrowbody planes in its fleet. As such, it cannot operate more than 320 65- to 76-seat regional jets. That's because 40% of 800 is 320 and so the number of regional jets in this category must not exceed that number.

Not only this but if American chose to expand its mainline operation, then it would surely require more pilots to operate those new planes. With a scope clause agreement, pilots at the regional carriers can get moved up to the mainlines sooner because the need for staffing is present. Therefore, instead of outsourcing the new mainline jobs, American can look to its regional operators and offer those pilots jobs at their mainline operations.

Manufacturer Impact

The effect of scope clauses transgresses the boundaries of the airlines. In fact, the aircraft manufacturers themselves can be affected by scope clause limitations as they would be required to design their aircraft in a way that fits the requirements.

United Airlines, for example, limit the amount of 51 to 76-seat aircraft they operate to 255 planes. Similarly, the amount of regional jets with 76 seats must not exceed 153 planes. However, United's limit on 50-seat aircraft is much more relaxed, with the limit of these planes being up to 90% of its total single-aisle fleet.

United and its regional subsidiaries operate a huge surplus of Embraer 170, 175, and Mitsubishi CRJ-700 aircraft. The CRJ-700s were all initially delivered with 70 seats and many remain with 70 seats.

However, when United began taking delivery of newer 76-seat Embraer 175 jets, it was quickly reaching the 255-plane limit of how many 51 to 76-seat aircraft it can operate. Not wanting to retire a bunch of CRJ-700s early, United embarked on a massive project to retrofit a significant number of these aircraft.

This project henceforth led to the introduction of the CRJ-550, a CRJ-700 that was reconfigured to have 50 seats.

The CRJ-550 was not the first instance of an airline removing seats from an already-existing regional jet. In fact, a number of years ago, Northwest Airlink reconfigured many of its existing 50-seat CRJ-200s to 44-seat "CRJ-440s" to meet restrictions at the time.

All of this information brings us full circle to the question posed earlier. If the Embraer 175 is so popular in the United States, why, then, has the new and improved E175-E2 failed to garner even a single order in the country?

A Configuration Conundrum

The reason for this is not capacity. The E175-E2 is roughly 24 inches (60 centimeters) longer than the standard E175 and as such, has a maximum capacity of 90 passengers. But still, U.S. airlines would be able to reconfigure the aircraft so that it only has 76 seats.

The deal-breaker of the E175-E2 is its weight. As mentioned earlier, scope clauses state that the MTOW for any regional jet in the United States must not exceed 86,000 pounds.

Thanks to its larger Pratt & Whitney PW1100G turbofan engines, the E175-E2 exceeds the maximum weight limit by 12,000 pounds, making it quite literally too heavy to operate for U.S. airlines.

Believe it or not, the scope clause limitations have also, in a way, impacted sales of the standard Embraer 175.

This is because the E175 comes in two models: the E175LR and E175AR. According to Embraer, the maximum takeoff weight of the "AR" is 89,000 pounds, 3,000 pounds too heavy to be operated in the States.

However, the "LR" version has an MTOW of 85,517 pounds, hence why it's the only one of the two variants seen in the States.

The Future of Scope Clauses

As long as regional airlines continue to operate in the United States, scope clauses will have to be present. If any regional carrier hopes to take delivery of brand new planes, those planes must fit the limitations stipulated in the clauses.

At the moment, the newest airplane any U.S.-based regional carrier can hope to take delivery of is the Embraer 175LR. This is because out of all the regional jets currently flying in the United States, the Embraer 175 is the only one still in production. The other most recent jet was the Mitsubishi CRJ-900. This aircraft is still very popular in the U.S. but ceased production in 2021.

In conclusion, scope clauses and their complicated, ever-changing nature will continue to regulate regional airline operations for seemingly the rest of time. It will be interesting to see if at any point in the future, we will see U.S. airlines and aircraft manufacturers finally produce a brand-new regional jet that will serve as a proper replacement to the venerable CRJ and E-Jets that U.S. flyers have come to love over the years.

Comments (8)

Kim Jensen

So simple question: There always seems to be a perpetual shortage of airline pilots, so how is "saving union jobs" even an issue? Also, why are ALL pilots not unionized so the question becomes moot as to what planes are flown?

After all, larger planes are needed for longer flights regardless and consumer demands will not accept multiple "puddle jumper" flights to go across the country to begin with. So why scope clauses at all?

If all pilots were unionized, non of this would matter to begin with and airlines could seek out the most efficient planes to move people with. This seems to be one area where completion in Capitalism still actually works, if all pilots are simply unionized.

Kim Jensen

So simple question: There always seems to be a perpetual shortage of airline pilots, so how is "saving union jobs" even an issue? Also, why are ALL pilots not unionized so the question becomes moot as to what planes are flown?

After all, larger planes are needed for longer flights regardless and consumer demands will not accept multiple "puddle jumper" flights to go across the country to begin with. So why scope clauses at all?

If all pilots were unionized, non of this would matter to begin with and airlines could seek out the most efficient planes to move people with. This seems to be one area where completion in Capitalism still actually works, if all pilots are simply unionized.

Irinmli

Good afternoon <a href=https://ped-pressa.kiev.ua/>.</a>

I found your forum very attractive and promising.

I want buy advertising space for a banner in the header , for $ 500 per month.

Pay I will be through WebMoney, 50% immediately, and 50% in 2 weeks. And yet, the address of my blog https://ped-pressa.kiev.ua/ - will it not contradict the topic? Thank you!

Write about your decision to me in the PM or to the mail irina2020kobzar2020@gmail.com

Irinmli

Good afternoon <a href=https://ped-pressa.kiev.ua/>.</a>

I found your forum very attractive and promising.

I want buy advertising space for a banner in the header , for $ 500 per month.

Pay I will be through WebMoney, 50% immediately, and 50% in 2 weeks. And yet, the address of my blog https://ped-pressa.kiev.ua/ - will it not contradict the topic? Thank you!

Write about your decision to me in the PM or to the mail irina2020kobzar2020@gmail.com

Irintzd

Good afternoon <a href=https://ped-pressa.kiev.ua/>.</a>

I found your forum very attractive and promising.

I want order advertising space for a banner in the top of the site, for $ 500 per month.

Pay I will be through WebMoney, 50% immediately, and 50% in 2 weeks. And yet, the address of my site https://ped-pressa.kiev.ua/ - will it not contradict the topic? Thank you!

Send a letter about your decision to me in the PM or to the mail irina2020kobzar2020@gmail.com

Irintzd

Good afternoon <a href=https://ped-pressa.kiev.ua/>.</a>

I found your forum very attractive and promising.

I want order advertising space for a banner in the top of the site, for $ 500 per month.

Pay I will be through WebMoney, 50% immediately, and 50% in 2 weeks. And yet, the address of my site https://ped-pressa.kiev.ua/ - will it not contradict the topic? Thank you!

Send a letter about your decision to me in the PM or to the mail irina2020kobzar2020@gmail.com

Irinrgf

Good day <a href=https://ped-pressa.kiev.ua/>.</a>

I found your forum very attractive and promising.

I want place advertising space for a banner in the top of the site , for $ 500 per month.

Pay I will be through WebMoney, 50% immediately, and 50% in 2 weeks. And yet, the address of my portal https://ped-pressa.kiev.ua/ - will it not contradict the topic? Thank you!

Please write about your decision to me in the PM or to the mail irina2020kobzar2020@gmail.com

Irinrgf

Good day <a href=https://ped-pressa.kiev.ua/>.</a>

I found your forum very attractive and promising.

I want place advertising space for a banner in the top of the site , for $ 500 per month.

Pay I will be through WebMoney, 50% immediately, and 50% in 2 weeks. And yet, the address of my portal https://ped-pressa.kiev.ua/ - will it not contradict the topic? Thank you!

Please write about your decision to me in the PM or to the mail irina2020kobzar2020@gmail.com

Irinifg

Good afternoon <a href=https://ped-pressa.kiev.ua/>.</a>

I found your forum very attractive and promising.

I want buy advertising space for a banner in the header , for $ 500 per month.

Pay I will be through WebMoney, 50% immediately, and 50% in 2 weeks. And yet, the address of my site https://ped-pressa.kiev.ua/ - will it not contradict the topic? Thank you!

Write about your decision to me in the PM or to the mail irina2020kobzar2020@gmail.com

Irinifg

Good afternoon <a href=https://ped-pressa.kiev.ua/>.</a>

I found your forum very attractive and promising.

I want buy advertising space for a banner in the header , for $ 500 per month.

Pay I will be through WebMoney, 50% immediately, and 50% in 2 weeks. And yet, the address of my site https://ped-pressa.kiev.ua/ - will it not contradict the topic? Thank you!

Write about your decision to me in the PM or to the mail irina2020kobzar2020@gmail.com

Iringaw

Good day <a href=https://ped-pressa.kiev.ua/>.</a>

I found your forum very attractive and promising.

I want buy advertising space for a banner in the top of the site, for $ 500 per month.

Pay I will be through WebMoney, 50% immediately, and 50% in 2 weeks. And yet, the address of my site https://ped-pressa.kiev.ua/ - will it not contradict the topic? Thank you!

Send a letter about your decision to me in the PM or to the mail irina2020kobzar2020@gmail.com

Iringaw

Good day <a href=https://ped-pressa.kiev.ua/>.</a>

I found your forum very attractive and promising.

I want buy advertising space for a banner in the top of the site, for $ 500 per month.

Pay I will be through WebMoney, 50% immediately, and 50% in 2 weeks. And yet, the address of my site https://ped-pressa.kiev.ua/ - will it not contradict the topic? Thank you!

Send a letter about your decision to me in the PM or to the mail irina2020kobzar2020@gmail.com

Irinzqc

Good afternoon <a href=https://ped-pressa.kiev.ua/>.</a>

I found your forum very attractive and promising.

I want buy advertising space for a banner in the header , for $ 500 per month.

Pay I will be through WebMoney, 50% immediately, and 50% in 2 weeks. And yet, the address of my portal https://ped-pressa.kiev.ua/ - will it not contradict the topic? Thank you!

Please write about your decision to me in the PM or to the mail irina2020kobzar2020@gmail.com

Irinzqc

Good afternoon <a href=https://ped-pressa.kiev.ua/>.</a>

I found your forum very attractive and promising.

I want buy advertising space for a banner in the header , for $ 500 per month.

Pay I will be through WebMoney, 50% immediately, and 50% in 2 weeks. And yet, the address of my portal https://ped-pressa.kiev.ua/ - will it not contradict the topic? Thank you!

Please write about your decision to me in the PM or to the mail irina2020kobzar2020@gmail.com

Irinhni

Good afternoon <a href=https://ped-pressa.kiev.ua/>.</a>

I found your forum very attractive and promising.

I want buy advertising space for a banner in the top of the site , for $ 500 per month.

Pay I will be through WebMoney, 50% immediately, and 50% in 2 weeks. And yet, the address of my page https://ped-pressa.kiev.ua/ - will it not contradict the topic? Thank you!

Write about your decision to me in the PM or to the mail irina2020kobzar2020@gmail.com

Irinhni

Good afternoon <a href=https://ped-pressa.kiev.ua/>.</a>

I found your forum very attractive and promising.

I want buy advertising space for a banner in the top of the site , for $ 500 per month.

Pay I will be through WebMoney, 50% immediately, and 50% in 2 weeks. And yet, the address of my page https://ped-pressa.kiev.ua/ - will it not contradict the topic? Thank you!

Write about your decision to me in the PM or to the mail irina2020kobzar2020@gmail.com

Add Your Comment

SHARE

TAGS

INFORMATIONAL Regional Airlines Scope Clause American Eagle United Express Delta Connection Embraer E175-E2 Regional JetsRECENTLY PUBLISHED

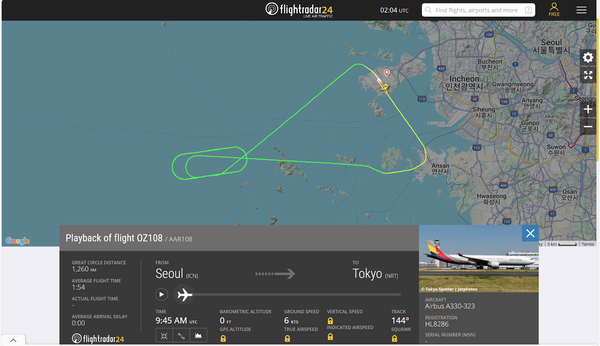

Tokyo-Bound Asiana Flight Experiences Engine Failure

An Asiana Airlines flight bound for Tokyo experienced an engine failure, prompting its return to Incheon International Airport.

NEWS

READ MORE »

Tokyo-Bound Asiana Flight Experiences Engine Failure

An Asiana Airlines flight bound for Tokyo experienced an engine failure, prompting its return to Incheon International Airport.

NEWS

READ MORE »

Learjet Owned By Vince Neil Crashes Into Gulfstream Jet, 1 Fatality Confirmed

On February 10th, around 14:30 local time, a Learjet private jet aircraft crashed into another private jet after landing at Scottsdale Airport (SCF) in Arizona.

NEWS

READ MORE »

Learjet Owned By Vince Neil Crashes Into Gulfstream Jet, 1 Fatality Confirmed

On February 10th, around 14:30 local time, a Learjet private jet aircraft crashed into another private jet after landing at Scottsdale Airport (SCF) in Arizona.

NEWS

READ MORE »

Seattle Plane Strike 2025: Japan Airlines and Delta Collision Raises Safety Concerns

Seattle-Tacoma International Airport saw a concerning incident on Wednesday morning when a Japan Airlines (JAL) plane clipped a parked Delta Air Lines jet while taxiing. Thankfully, no one was injured, but passengers described the collision as a frightening experience.

NEWS

READ MORE »

Seattle Plane Strike 2025: Japan Airlines and Delta Collision Raises Safety Concerns

Seattle-Tacoma International Airport saw a concerning incident on Wednesday morning when a Japan Airlines (JAL) plane clipped a parked Delta Air Lines jet while taxiing. Thankfully, no one was injured, but passengers described the collision as a frightening experience.

NEWS

READ MORE »